There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

(must course for Bank Executives interested in learning Pre-Sanction skills covering Credit Analysis, Financial Analysis & Underwriting)

layers 48 Courses

Language: English

Validity Period: 365 days

Are you a Bank Executive interested in working / likely to join Credit or Advance Profile in SME & Corporate Banking Credit Segment?

Are you interested in learning Pre-Sanction Credit & Financial Analysis skills required for SME & Corporate Banking Credit?

Are you looking for a comprehensive and structured Online Course through which you can learn this most sought-after highly coveted skill at your own pace and timing without disturbing your official working hours?

Are you the one aspiring highest level of growth in your Banking Career?

or

Are you a Finance Executive / Professional, a Student, an Entrepreneur interested in gaining insight into a banker's perspective of Credit and Financial Analysis?

Then this course is for you!

Credit & Financial Analysis Mastery Bundle (for Bankers)

(must course for Bank Executives interested in learning Pre-Sanction skills covering Credit Analysis, Financial Analysis & Underwriting)

By enrolling in this course, you will learn the Pre-Sanction Credit Underwriting process covering Credit Analysis and Financial Analysis specific to SME & Corporate Banking Credit Segment. This course is basically a bundle of series of modules taking you through each and every of Pre-Sanction Process.

By enrolling in this course, you will learn

1) Module 1 - Basics of Credit Analysis

2) Module 2 - How to Read Balance Sheet

3) Module 3 - How to do Financial Ratio Analysis?

4) Module 4 - How to do Cash Flow Analysis?

5) Module 5 - How to do Fund Flow Analysis?

6) Module 6 - How to carry out Credit Risk Rating for Non-Trading Entities?

7) Module 7 - How to carry out Credit Risk Rating for Trading Entities?

8) Module 8 - How to prepare CMA Report for Bank Loans?

9) Module 9 - How to prepare Cash Budget for Bank Loans?

10) Module 10 - How to Assess Fund Based Working Capital (CC / OD) as Banker?

11) Module 11 - How to assess Non Fund Based Credit Facility (LC & BG) Assessment as a Banker?

12) Module 12 - How to do Term Loan Appraisal & Assessment as a Banker?

13) Module 13 - Basic Elements of Loan Proposal

14) Module 14 - Case Studies related to Credit Analysis

15) Module 15 - Collateral Securities

16) Module 16 - Q and A

Financial Ratio E-Books

17) Basics of Financial Ratio Analysis

18) Deep dive into the Current Ratio

19) Deep dive into Debt-Equity Ratio

20)Deep dive into Debt Service Coverage Ratio (DSCR)

21)Deep dive into Inventory Turnover Ratio

Financial Management related E-Books

22) Cash Flow Analysis

23) Capital Structuring

24) Financial Break Even Point

25) Capital Budgeting and Cash Flow

26) Capital Budgeting and Payback and Time Value of Money (Part 1)

27) Capital Budgeting and Payback and Time Value of Money (Part 2)

28) Conversation about Leverage

Financial Analysis related E-Books

29) Financial Analysis: Common Mistakes to Avoid

30) Financial Statement Analysis: Short Notes

31) Simple Guide to the Balance Sheet: 40 Questions & Answers

Credit Analysis related EBooks:

32) Introduction to Credit Analysis & Underwriting

33) The SME Lender's Handbook: A Guide to Fraud Detection and Prevention

Test Series:

34) Test your knowledge in Analysis of Financial Statements

35) Test your knowledge in Financing Working Capital Requirements

36) Test Your Knowledge in Ratio Analysis

Template:

37) Project Report & CMA Template

Audio Book:

38) Audio Book on Types of Financing

Video Book:

39) Financial Statements 101: A Question-and-Answer Guide

Career Guidance Material:

40) The Road to the Top: Navigating Your Way from Bank PO to MD

Bonus Resource:

41) Child Future Education - Financial Planning Template

What makes this course special for you?

🔥It’s all pre-recorded classes.

🔥You can access it any time.

🔥You can access it any number of times.

🔥You can also download courses on your mobile through our learning app and access them later without the internet

🔥You get a certificate of completion upon 100% completion of the course

🔥Lowest & Affordable price in the market

🔥Lifetime Q&A support through telegram group

FREQUENTLY ASKED QUESTIONS:

Q1: How to enroll in the course?

Follow these steps:

~Click "add to cart." If you're not signed up, it will direct you to the sign-up page.

~Complete the payment at the gateway.

~You'll receive payment confirmation and course access details via email and WhatsApp.

Q2: How do I access the course after enrollment?

You can access the course on a desktop, laptop, or through Android or iPhone mobile learning apps. For detailed instructions, visit: https://bit.ly/3PTZNvI

Q3: How are doubts resolved?

You will get access to a private Telegram community for questions and answers. Post your doubts, and they will be addressed by the instructor or other mentors (senior bankers and finance professionals) in the community.

Q4) Are the courses Pre-Recorded or LIVE?

All courses are pre-recorded, offering flexibility for you to access them at your convenience.

Q5) How many times can I access the course?

You can access the course as many times as needed during the course period.

Q6) Can I download the courses?

Yes, download courses onto your mobile device using our learning app for offline access.

Q7) Do you provide a certificate of completion?

Upon completing 100% of the course, you'll receive a certificate.

Q8) Any Demo Videos?

Explore our YouTube Channel, CA Raja Classes, for 2000+ Demo Videos:

https://www.youtube.com/c/CARAJACLASSES/feed?sub_confirmation=1

FREE demo lectures on Credit and Financial Analysis:

https://courses.carajaclasses.com//s/pages/demo-cfamb

Q9) How much time is required for the module?

The course comprises 100+ hours of learning resources in the form video lectures and reading materials. Allocate 30-45 minutes per day and 1.5 to 2 hours on holidays over 3-4 months for completion.

Q10) How does the course impact my career?

The course imparts essential skills for credit and financial analysis, crucial in banking. Those who have completed it demonstrate enhanced performance in credit-related jobs and interviews. Banks value officers with such knowledge, making this course a valuable asset for career advancement.

.png)

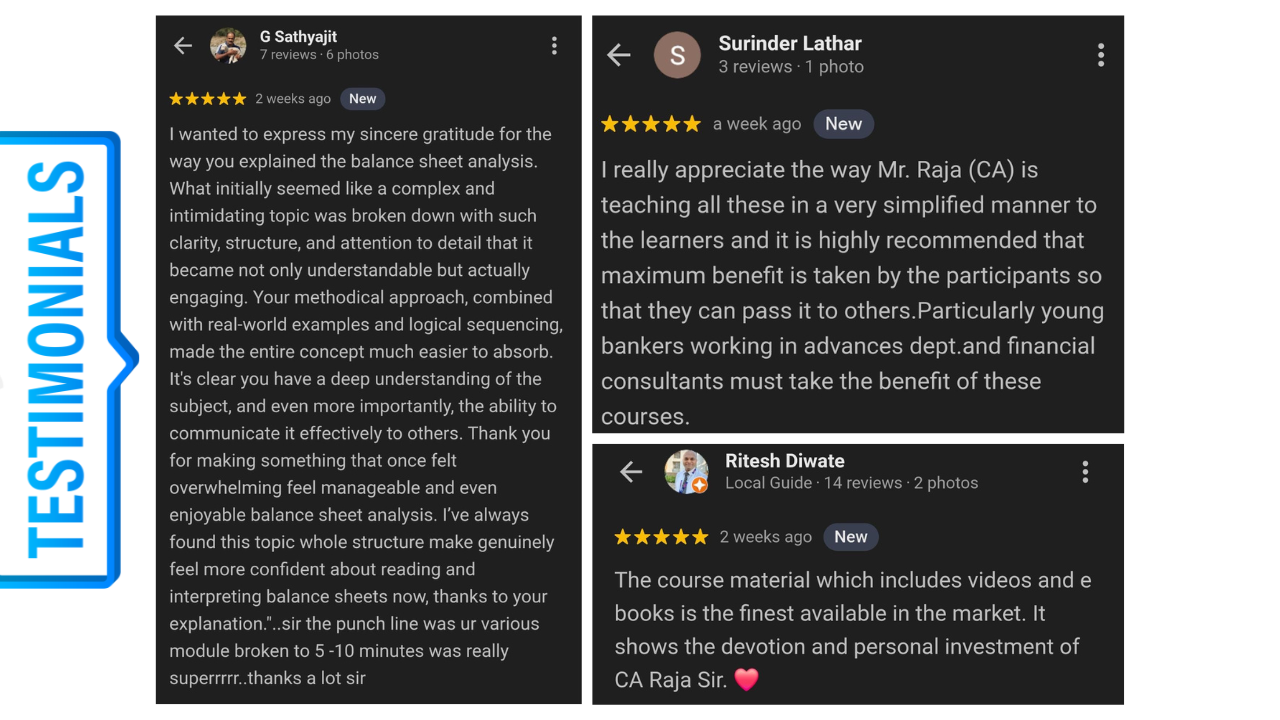

Review / Feedback of learners:

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)